U.S. Natural Gas Exports: A Pillar of the Transatlantic Alliance

Following Russia’s invasion of Ukraine, U.S. liquefied natural gas (LNG) emerged as a vital solution to help Europe weather the energy crisis, keep its economy running, and ultimately reduce its dependence on Russian gas. This shift not only strengthens global energy security, specifically for our partners in Europe, but also supports U.S. economic growth and geopolitical influence.

However, the work to secure Europe’s energy is not over, as the EU still imports nearly 20% of its gas from Russia. Both sides of the Atlantic must act now to fully decouple Europe from Russia and its weaponization of energy. In May, The European Commission released its roadmap to phase out Russian gas by 2027, but the bloc’s ability to follow through on this policy depends on transatlantic cooperation between governments and the ability of American producers and exporters to reliably deliver gas to our European allies. In the U.S., that means Congress reforming our permitting process to enable the expansion of natural gas infrastructure, including LNG facilities, to do our part to ensure that the EU is able to reliably replace Russian gas.

The Risks Rise to the Top

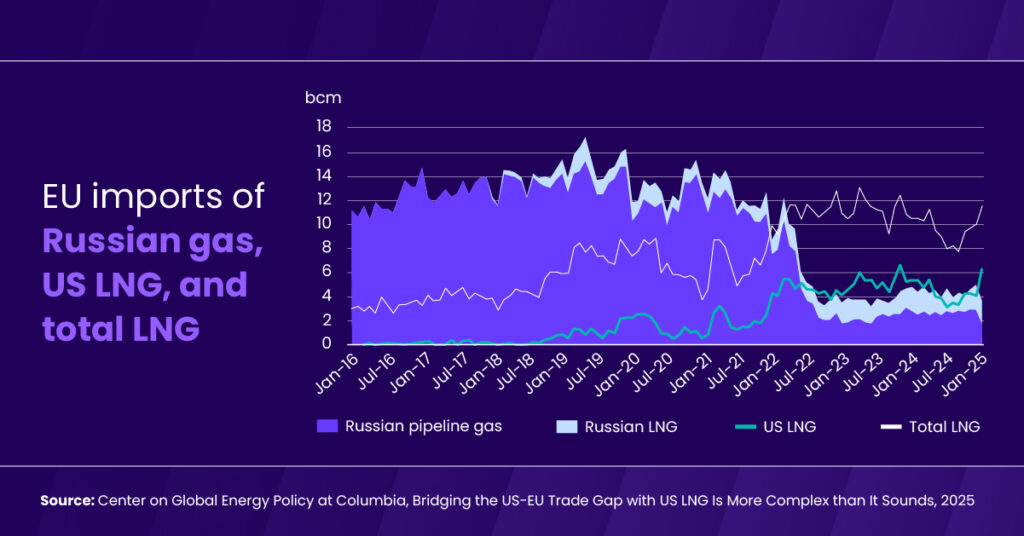

Before 2022, Russia supplied over 40% of Europe’s gas, but the invasion of Ukraine quickly exposed the dangers of Europe’s dependence on Russia for energy.

Following the invasion, Russia cut-off pipeline gas deliveries to most of Europe, leading to a significant supply shortfall and spurring an energy crisis. An S&P Global study showed that the curtailment of Russian gas supplies led to a spike in gas prices, which reduced Europe's gas consumption by 19%, drove global benchmark energy prices to record highs, and impacted economic growth.

In the face of this crisis, the U.S. was instrumental in quickly filling the gap left by Russia with LNG exports. According to S&P Global, U.S. LNG exports to Europe more than doubled—from 2.1 bcf/d between 2019 and 2021 to 5.6 bcf/d in 2024, with the U.S. now accounting for 46% of the EU’s LNG imports and 18% of its total natural gas.

The Opportunity for U.S. LNG

Given the geopolitical risks of relying on Kremlin-backed natural gas and the demonstrated reliability of American exporters, Europe is well positioned to accelerate its phase-out of Russian gas. In the absence of Russian gas, U.S. LNG—delivered through flexible long-term contracts—can meet European demand, especially as export capacity is set to grow by nearly 50% with the addition of Plaquemines LNG, Corpus Christi LNG, and Golden Pass LNG. With U.S. producers leading in methane reduction, American LNG also offers a cleaner alternative to help the EU meet its climate goals.

“The time is ripe for even greater cooperation (between the U.S. and EU) on LNG. The recognition that U.S. LNG will be more secure, U.S LNG will be cleaner and that it will be easier ultimately to work with U.S. to comply with EU regs with respect to methane.”

Richard Morningstar, Former US Ambassador to the European Union and PAGE Advisory Council Member

Permitting Reform is Key

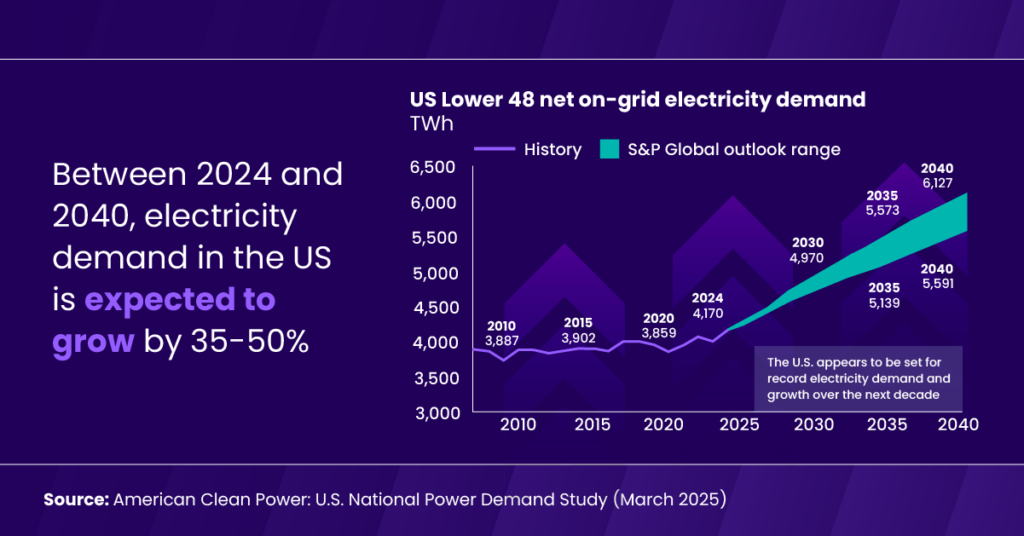

Unfortunately, regulatory bottlenecks continue to hinder the U.S.’s ability to fully realize its LNG export potential. For too long, outdated permitting processes have limited infrastructure development and constrained export capacity—just as global demand for reliable energy sources is rising.

As the U.S. works to stay economically competitive and strengthen energy security at home and abroad, policymakers must prioritize permitting reform and invest in natural gas infrastructure. Expanding pipelines and LNG facilities will not only drive domestic growth but also demonstrate to Europe that the U.S. is a reliable, long-term energy partner. Achieving this vision would reinforce global momentum for continued sanctions on Russian LNG and solidify the U.S. as the cornerstone of global energy leadership for the future.